Areas of Expertise

- Legacy Planning

- Retirement Strategies

- Investment and Assets Optimisation

Education

- NUS, BSc in Real Esate

- Associate Estate Planning Practitioner (AEPP)

- Associate Financial Consultant (AFC)

Awards

- Million Dollar Round Table (MDRT) 2021/2022/2023/2024/2025

- International Dragon Award (Bronze)

- Award-Winning Financial Director

Professional Summary

- Seasoned expert in estate and investment strategies, specialising in retirement optimisation and asset allocation

- Proficient in legacy and estate planning, ensuring assets are protected and distributed according to clients’ wishes

- Skilled in maximising benefits from government schemes like CPF Life, SRS, Careshield, and Medishield

- Frequent speaker for multinational corporations and large firms, offering insights on financial planning

Victor TuarFinancial Services Director

contact details

With over 15 years of experience in estate planning and investment management, Victor Tuar is a trusted authority in retirement optimization and asset allocation strategies. As a seasoned expert, he is dedicated to helping clients protect, grow, and efficiently transfer their wealth.

Victor specializes in creating personalized estate and investment strategies, focusing on retirement optimization, legacy preservation, and asset protection. An award-winning Financial Services Director, he has delivered multiple public talks on CPF-related topics for multinational corporations, sharing his expertise in maximizing government benefits for long-term financial security. His in-depth knowledge of government schemes—such as CPF Life, SRS, Careshield, and Medishield—enables him to advise clients on maximizing the benefits of these programs. Through a combination of tailored investment planning and thoughtful estate structuring, Victor ensures that his clients’ financial futures are well-planned and secure.

Victor’s approach is rooted in listening and understanding each client’s unique goals and concerns. He takes the time to educate clients on various financial schemes and estate planning options, empowering them to make informed decisions about their future. Recognized for his commitment and expertise, he has become a respected speaker on CPF and retirement topics, sharing insights with audiences at MNCs. Whether planning for retirement, preserving a legacy, or maximizing government benefits, Victor Tuar is committed to helping his clients achieve financial confidence and peace of mind.

Areas of Expertise

- Legacy Planning

- Retirement Strategies

- Investment and Assets Optimisation

Education

- NUS, BSc in Real Esate

- Associate Estate Planning Practitioner (AEPP)

- Associate Financial Consultant (AFC)

Awards

- Million Dollar Round Table (MDRT) 2021/2022/2023/2024/2025

- International Dragon Award (Bronze)

- Award-Winning Financial Director

Professional Summary

- Seasoned expert in estate and investment strategies, specialising in retirement optimisation and asset allocation

- Proficient in legacy and estate planning, ensuring assets are protected and distributed according to clients’ wishes

- Skilled in maximising benefits from government schemes like CPF Life, SRS, Careshield, and Medishield

- Frequent speaker for multinational corporations and large firms, offering insights on financial planning

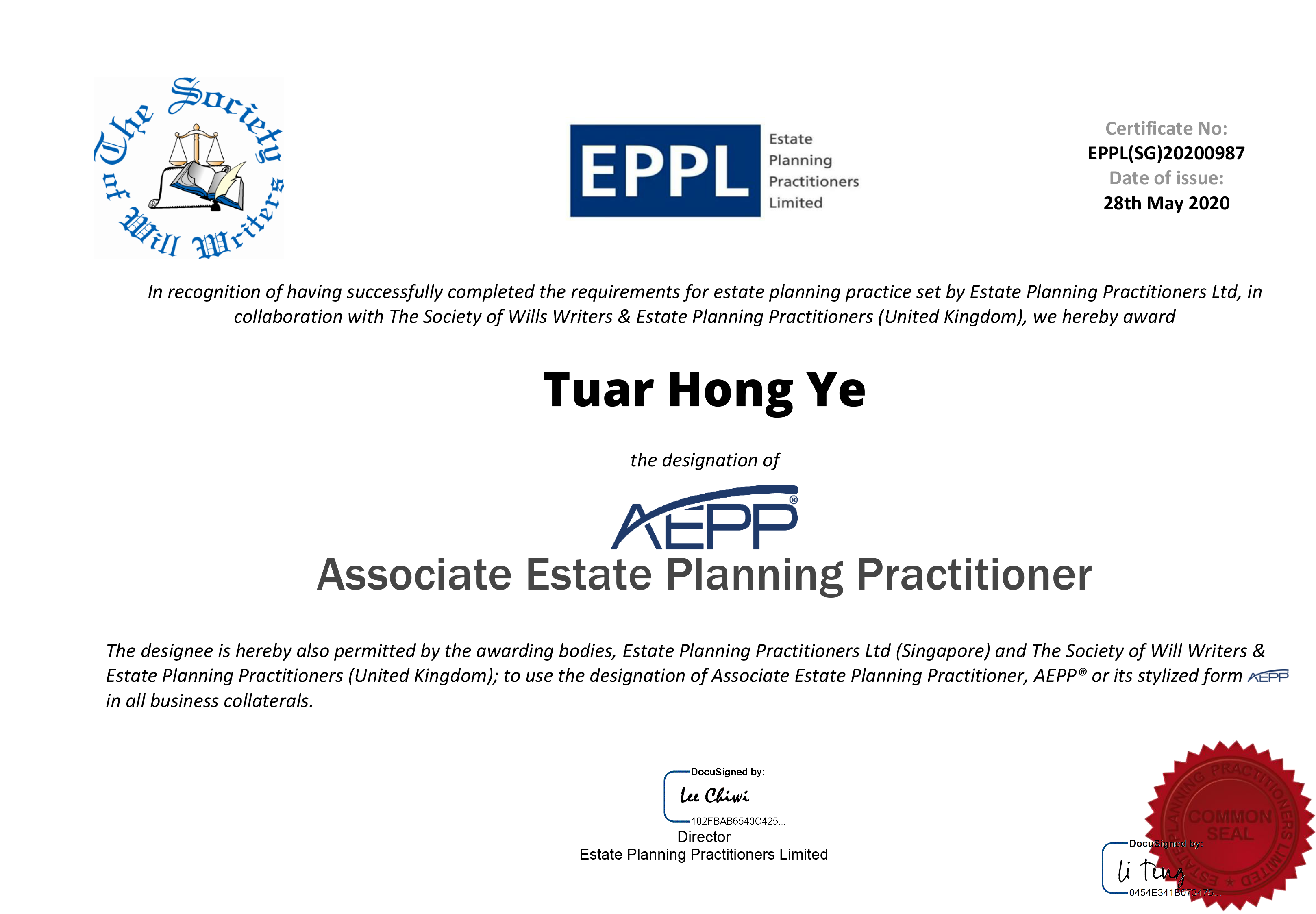

AEPP Certified

The AEPP® certification represents a notable step for financial advisors, showcasing their dedication to refining their skills in estate planning. Through practical application and guidance from experienced practitioners, AEPP® designates gain valuable insights to address their clients’ needs in wealth succession and asset protection. This certification highlights their capacity to offer meaningful value to their clients’ financial plans, delivering customized solutions aligned with their long-term goals and objectives.

The Associate Estate Planning Practitioner (AEPP®) designation is awarded by the Society of Will Writers (SWW) of the UK and the Estate Planning Practitioners Limited (EPPL).

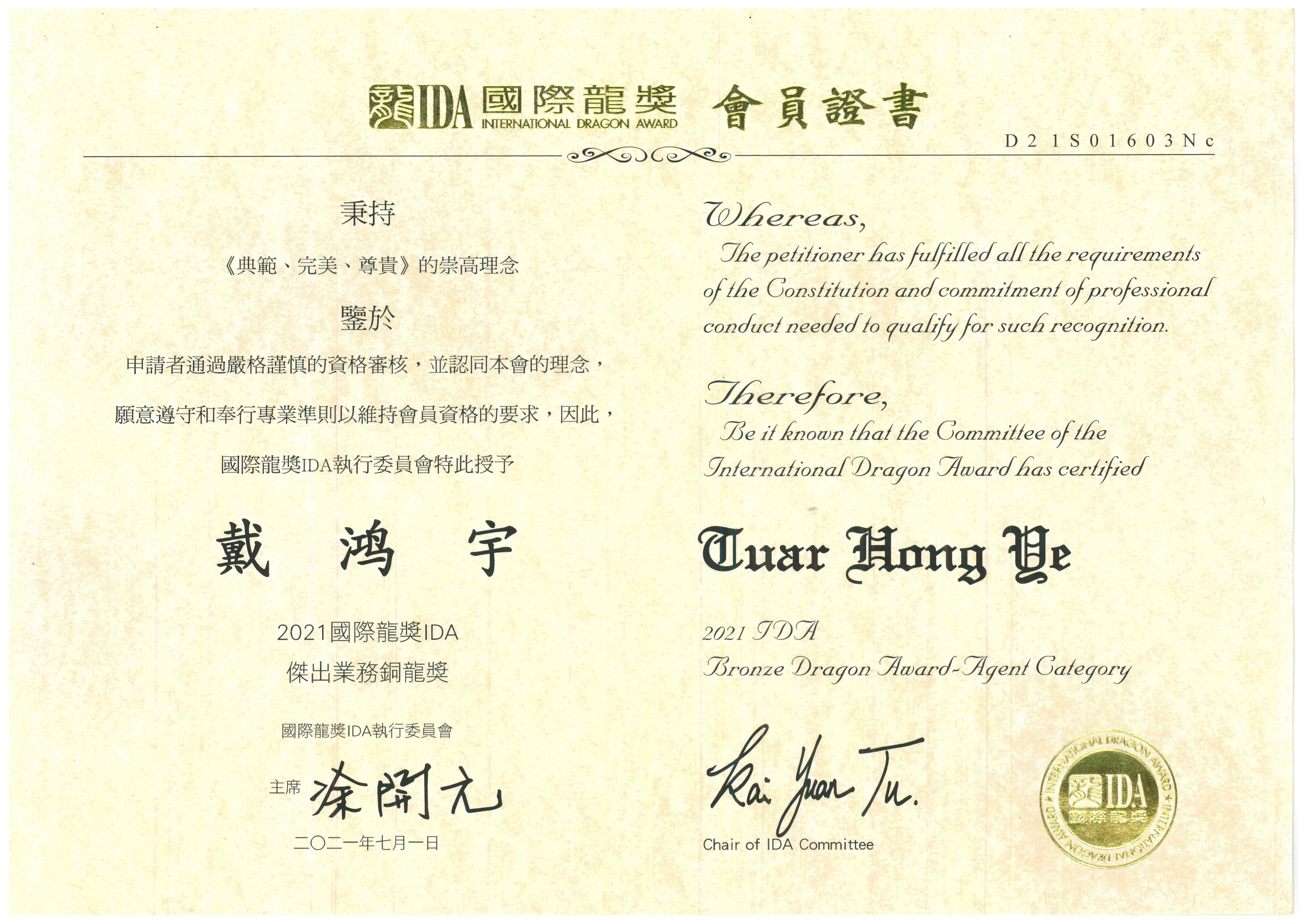

International Dragon Award (IDA)

To highlight the pivotal role and achievements of financial insurance practitioners in advancing the insurance sector, and to provide a dedicated international platform to recognize and honour those striving for excellence in the financial insurance industry, the Insurance Marketing Group established the International Dragon Award (IDA) in 1998. Guided by the principles of “Paragon, Perfection, Nobility”, the IDA sets world-class standards, aimed at fostering exceptional sales productivity and organisational development. Through its rigorous application and award ceremonies, the IDA celebrates the exceptional achievements of its members worldwide. Over the past 25 years, the IDA has garnered widespread recognition and acclaim from over 250 major financial insurance institutions across 17 countries and regions, with a cumulative membership exceeding 163,000 individuals.

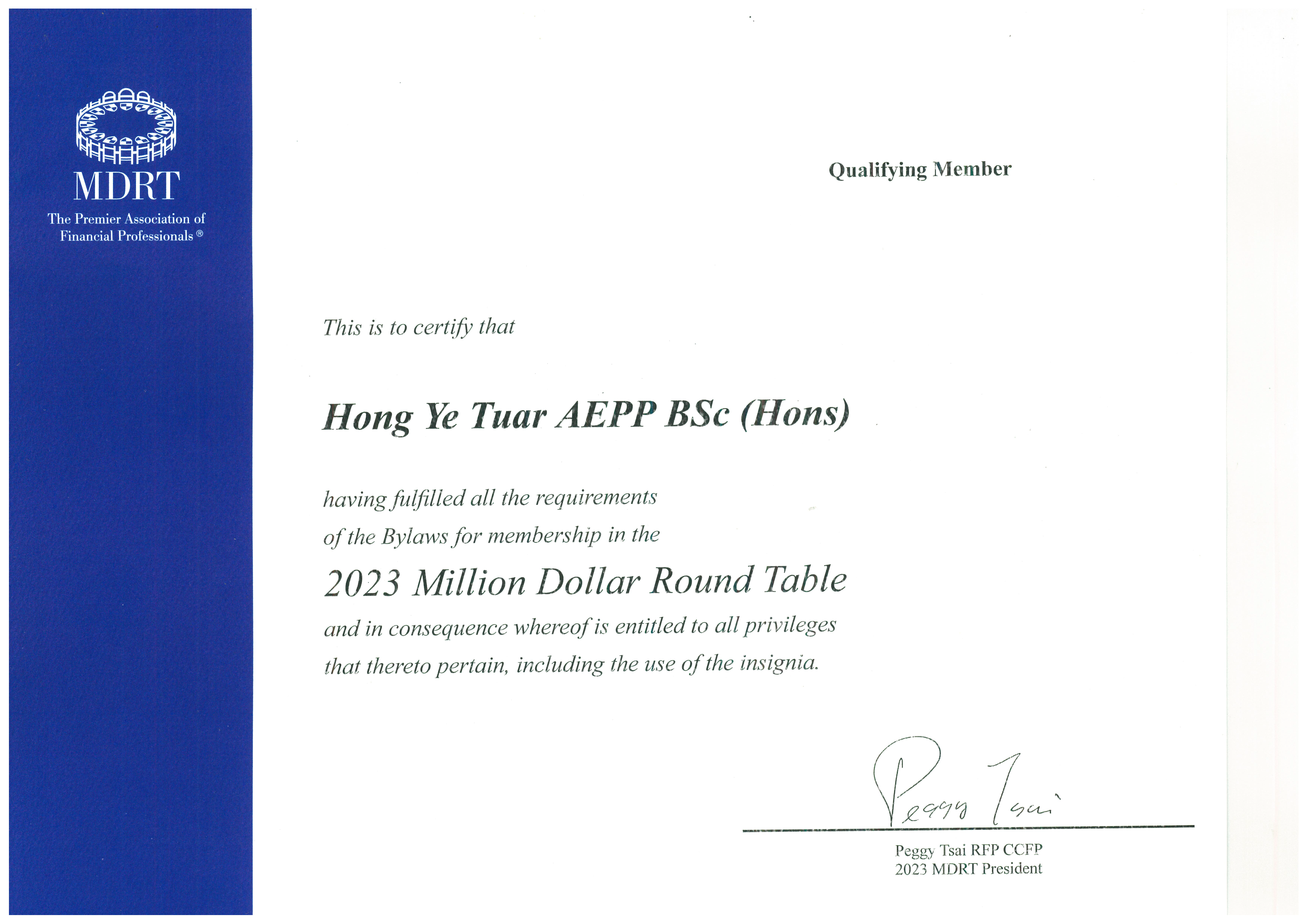

MDRT Certified

The Million Dollar Round Table (MDRT) certification is a prestigious, globally recognized mark of excellence in the financial services industry. Achieving MDRT status signifies a high level of professional expertise, ethical standards, and exceptional client service. Members must meet rigorous performance and production criteria, placing them among the top financial advisors worldwide, known for their commitment to comprehensive financial planning and client-centered solutions.

Trust Introducer Certification

The Trust Introducer certification recognizes professionals trained in the essentials of trust planning, estate management, and client onboarding for wealth transfer. Certified Trust Introducers have a foundational understanding of wills, trusts, and succession strategies, allowing them to connect clients with the right solutions for securing and managing their assets across generations. This certification emphasizes an advisor’s commitment to offering clients tailored and secure wealth preservation options.

Estate & Succession Practitioner Certification

The Estate & Succession Practitioner certification recognizes expertise in estate planning, wills, and trusts. Certified practitioners are equipped with advanced skills to guide clients in preserving, managing, and transferring wealth according to their wishes. This certification ensures that practitioners are knowledgeable in succession strategies and compliant with industry standards, providing clients with comprehensive and reliable estate planning solutions.

Wall of Trust

“EXPERT GUIDANCE IN ORGANIZING MY FINANCIAL FUTURE”

Victor has been instrumental in organizing and optimizing my insurance and investment portfolio, ensuring everything is aligned with my financial goals. He provided invaluable support in my legacy and estate planning, going above and beyond with meticulous attention to detail. I’m grateful for his comprehensive expertise and personalized approach.

– Gary Ong

Global Partner at Amazon Web Services

“SECURE SAVINGS PLANS FOR MY CHILDREN’S FUTURE”

Working with Victor has been an incredibly reassuring experience. He took the time to thoroughly understand my family’s needs and helped organize not only my insurance and investments but also introduced a well-structured savings plan for my kids. Victor’s guidance has given me confidence that my children’s financial future is well-protected and on track. His approach to legacy planning is thorough, and he made the process simple by explaining each step clearly and addressing any concerns I had along the way.

Victor’s dedication and commitment to his clients are unmatched, and I’m grateful for the peace of mind his expertise has provided. He truly treats his clients’ financial goals with the same care he would his own.

– Joshua Tan

Senior Engineer at PUB

“PERSONALIZED SOLUTIONS ALIGNED WITH MY INVESTMENT STYLE”

Victor took the time to understand my unique investment appetite and long-term financial needs, creating a tailored solution that perfectly matches my comfort level and goals. His recommendations weren’t one-size-fits-all; he thoughtfully considered my preferences, risk tolerance, and retirement vision to design a plan I feel confident about. I really appreciate his ability to balance expertise with a personalized approach, and I’m grateful to have a strategy that truly fits me.

“HOLISTIC PLANNING WITH FREEDOM TO CHOOSE”

Victor delivered an exceptional overview of my finances, giving me a clear picture of where I stand and how to reach my retirement goals. He offered a range of options from various financial institutions, which allowed me to make informed choices without being tied to just one provider. This comprehensive approach gave me confidence that I’m getting the best possible solutions tailored to my needs. I’m grateful for his open, unbiased guidance.

“COMPREHENSIVE RETIREMENT PLAN WITH CLEAR PROJECTIONS”

Victor’s approach to retirement planning was incredibly thorough. He provided detailed CPF projections, including illustrations in charts and tables, which gave me a clear understanding of my future financial outlook. His ability to explain complex concepts simply made me feel confident in every decision we made. With Victor’s guidance, I now feel prepared and secure as I plan for a fulfilling retirement.

“STRESS-FREE PLANNING FOR A BRIGHT RETIREMENT FUTURE”

Victor made retirement planning a completely stress-free experience. He took the time to address all my concerns and provided a retirement plan that’s both practical and comprehensive. His expertise in CPF projections and asset management has given me confidence that my future is in good hands. Thanks to Victor, I can look forward to a comfortable retirement without worries.

“CLEAR FINANCIAL ROADMAP WITH EXPERT CPF INSIGHTS”

Victor has created a retirement roadmap that’s not only strategic but also easy to follow. His detailed CPF projections and visual aids in the form of charts and tables have clarified the big picture for me, removing the stress from the process. Victor’s support has been invaluable, and his commitment to making retirement planning accessible is something I truly appreciate.